nevada estate and inheritance tax

Nevada State Personal Income Tax. However if a beneficiary of an estate lives in a state that imposes an inheritance tax then the beneficiary may have to pay that tax to their state.

Recent Changes To Estate Tax Law What S New For 2019

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Legal Service Since 1999.

Inheritance and Estate Tax Rate Range. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Under Nevada probate law probate is the process of verifying the proper transfers of property after a persons death.

But Nevada does have a relatively high sales tax a state rate is around 7 but. If any personal representative fails to pay any tax imposed by NRS 375A100 for which he or she is liable before the date the tax becomes delinquent he or she must on motion of the. Chapter 150 of Title 12 of the Nevada Revised Statutes allows for compensation as outlined in the will.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. All Major Categories Covered. Nevada also has low property tax rates which will usually be half of 1 to 1 of assessed value.

Select Popular Legal Forms Packages of Any Category. The inheritance tax always goes hand-in-hand with the estate tax levied on the property of the recently deceased before it is transferred to heirs. Our Rule of Thumb for Las Vegas sales tax is 875.

Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is responsible for paying the tax. The State of Nevada sales tax rate is 46 added to. Describe Your Case Now.

In 2021 the first 117mil per individual is exempt at. However an estate in Nevada is still subject to federal inheritance tax. Nevada also does not have a local estate.

NV does not have state inheritance tax. Property Tax Rate Range. The federal estate tax exemption is 1118.

Seven states have repealed their estate taxes since 2010. Ad Review Attorney Profiles Ratings Cost Then Choose. From Fisher Investments 40 years managing money and helping thousands of families.

In 2021 the first 117mil per individual is. Nevada repealed its estate tax also called a pick-up tax on Jan. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Estate taxes and inheritance taxes are similar but there are some important differences to note. Nevada repealed its estate tax also called a pick-up. Inheritances that fall below these exemption amounts arent subject to the tax.

If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing until which time the Internal Revenue Service reenacts the Death Tax. Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up.

If the total amount of the deceased persons assets exceeds. Over 5 Million Cases Posted. Also when real estate is transferred from.

Delaware repealed its tax as of January 1 2018. Technically the Las Vegas sales tax rate is between 8375 and 875. Nevada is one of the seven states with no income.

No Estate Tax Laws in Nevada To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on. Under Nevada law there are no inheritance or estate taxes. Fortunately Nevada does not.

From Fisher Investments 40 years managing money and helping thousands of families. If you have questions regarding Nevada inheritance tax estate tax gift tax or any other estate. It is one of the 38 states that does not apply an estate tax.

States That Have Repealed Their Estate Taxes. NV does not have state inheritance tax. If no compensation was included in the will they can receive four percent of the first.

Here are the answers to five common Nevada inheritance tax questions. Estate tax of 306 percent to 16 percent for estates above 59 million.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

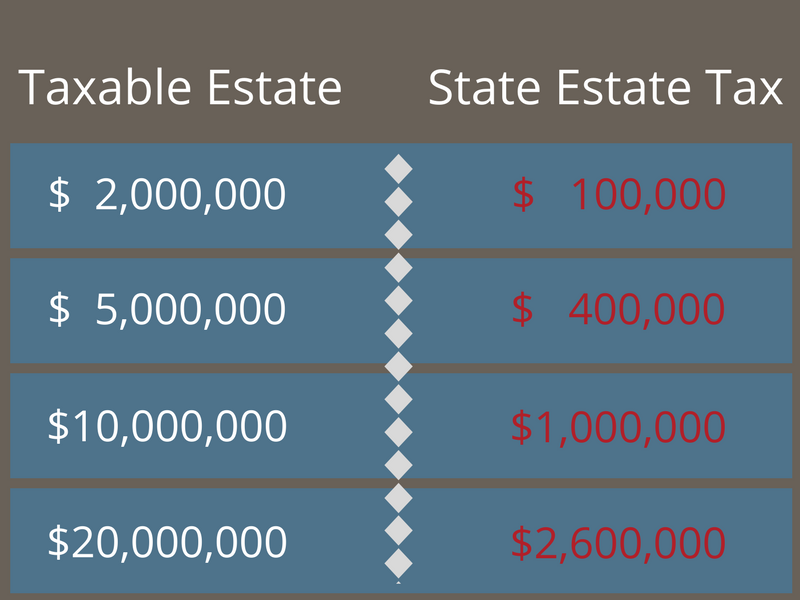

Oregon Estate Tax Everything You Need To Know Smartasset

Estate Tax Rates Forms For 2022 State By State Table

State Estate And Inheritance Taxes Itep

What Would Be The Consequences Of A 100 Inheritance Tax To A Nation S Economy Quora

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Recent Changes To Estate Tax Law What S New For 2019

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Changing Residency Affects State Estate Tax And Income Taxes

Quotes About Estate Taxes 29 Quotes

Estates And Trust Services Tax Lawyer Inheritance Tax Divorce Attorney

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

How To Avoid Estate Taxes With A Trust